Compliance

CTS supports various compliance hosting solutions to help businesses of all sizes and industries. Our compliance services have enabled several institutions, companies, and eCommerce companies to offer safe and secure services across their platforms for all customers. Through our services, every customer is assured that their private data is safe, their finances are in good hands, and that the company they’re entrusting their data assets with complies with stringent compliance regulations.

Written Information Security Plan (WISP)

Under the GLBA, tax and accounting professionals are classified as financial institutions, irrespective of their size. This rule applies not only to tax and accounting professionals but also extends to various other entities such as mortgage brokers, real estate appraisers, universities, nonbank lenders, and check cashing businesses.

To comply with the Safeguards Rule, the FTC mandates that each firm must:

- Designate one or more employees to oversee the coordination of its information security program

- Identify and evaluate risks associated with customer information within all relevant areas of the company’s operations. Furthermore, assess the effectiveness of existing safeguards in managing these risks.

- Develop and execute a safeguards program and regularly monitor and test its efficacy

- Select service providers capable of maintaining appropriate safeguards, with contracts requiring them to uphold these standards and oversee the handling of customer information

- Continuously assess and adapt the program as necessary, taking into account changing circumstances, such as shifts in the firm’s business or operations, or the results of security testing and monitoring

Not sure where to begin or have the resources to ensure you are compliant? Our team is experienced with implementing WISPs and will help you. Contact us to discuss partnering with our organization to develop your WISP.

Visit our Resources page to download our WISP template today!

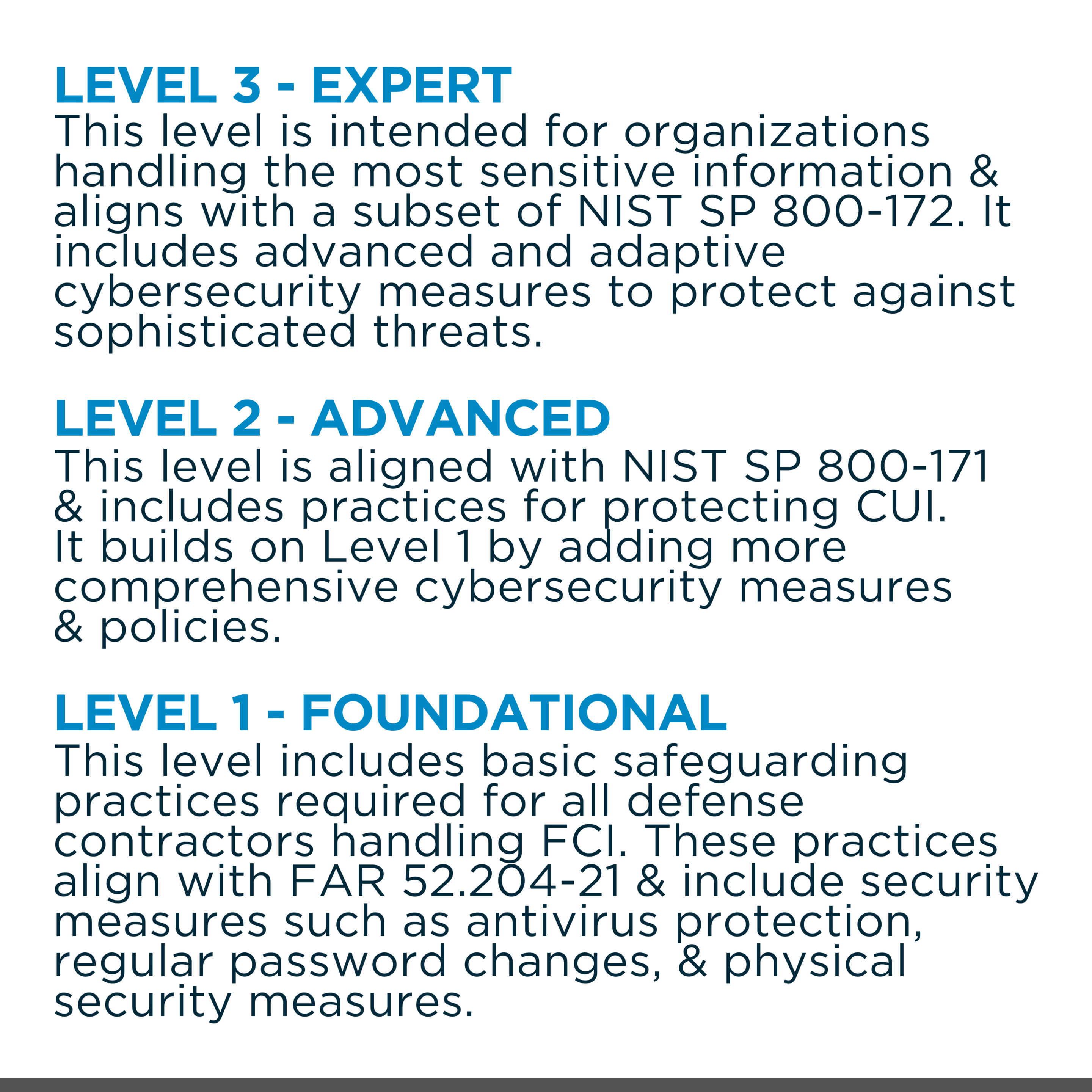

Cybersecurity Maturity Model Certification (CMMC)

Cybersecurity Maturity Model Certification (CMMC) is a framework developed by the United States Department of Defense (DoD) to ensure that suppliers, contractors, and subcontractors handling Federal Contract Information (FCI) and Controlled Unclassified Information (CUI) meet very specific cybersecurity standards to protect sensitive data from the evolving threat landscape. The final rule for the CMMC 2.0 initiative went into effect December 16th, 2024. The DoD has mandated that all government contractors competing for DoD contracts are CMMC 2.0 certified.

This follows the interim rule, previously published to the Defense Federal Acquisition Supplement (DFARS) in September 2020 by the DoD. The interim rule took effect on November 30th, 2020, and called for a phase in period of five years. In November 2021, the DoD announced CMMC 2.0 which serves to:

- Safeguard sensitive information to enable and protect the warfighter

- Enforce Defense Industrial Base (DIB) cybersecurity standards to meet evolving threats

- Ensure accountability while minimizing barriers to compliance with DoD requirements

- Perpetuate a collaborative culture of cybersecurity and cyber resilience

- Maintain public trust through high professional and ethical standards

Having been through many regulatory changes over the last 23+ years, we know that newly implemented policies can feel daunting. CTS is your CMMC expert, serving to explain the terms, how to prepare for assessment, and ultimately, how to monitor and maintain compliance. We have the resources you need to move forward in compliance, with peace of mind. To discuss partnering with us to achieve your CMMC, contact us today.

Payment Card Industry Data Security Standard (PCI DSS)

When people interact with companies online, they are entrusting their sensitive personal data to companies – especially those that process payments using credit card information. This can be nerve-wracking for customers.

To remedy this, a set of requirements called the “Payment Card Industry Data Security Standard” or the “PCI DSS” was designed to provide a standard that secures payment information. Companies that require this information are given a Merchant ID (MID) which the PCI SSC (Payment Card Industry Security Standards Council), an independent body created by major payment card brands (such as MasterCard, VISA, etc.), manages.

We provide cybersecurity services to help you with your PCI compliance. Our qualified experts can assist your staff to avoid non-compliance risks. We can also protect your website from potential online threats and also offer data backup, email encryption and other high-level security solutions. Contact us to discuss how we can work together to fulfill your PCI compliance.

Health Insurance Portability and Accountability Act (HIPAA)

Another type of sensitive information that needs protection is patient data from hospitals and other healthcare facilities. Because this data is as crucial as any other, it needs the right amount of safeguarding and security measures to make sure data breaches are not a concern. Companies, businesses, and institutions who provide/support treatment, perform healthcare operations, or have access to payment and/or patient records must comply with HIPAA requirements.

We provide high-level data protection to meet HIPAA standards. Our cybersecurity specialists can perform a thorough evaluation of your company’s PHI databases. CTS offers services to perform data backups, email encryption, and apply effective security solutions. Contact a CTS consultant to discover how to ensure HIPAA compliance for your company.

We're Here To Help!

Office

2033 N. Milwaukee Ave, Suite 351

Riverwoods, IL 60015